If you need capital for your start-up or your existing start-up company, the ERP loan StartGeld from KfW can be a solution. In this article you will get an overview of the ERP loan.

content of the article

What is the KfW Förderkredit?

The KfW Förderkredit is a state-subsidized loan for entrepreneurs offered by KfW Bankengruppe. It is intended for founders and companies with up to 10 employees and can amount to up to 50,000 euros. The loan is interest-free and repayment-free for the first two years and is then low-interest for another three years. Repayment is made in monthly installments. The loan can be used for various purposes, e.g. for investments, the establishment or expansion of the company, the acquisition of working capital or as a substitute for equity capital.

For whom is the ERP Gründerkredit - StartGeld suitable?

The ERP Start-up Loan – StartGeld is a special offer for entrepreneurs. It is aimed at entrepreneurs who want to start their business or expand it in the first three years of their self-employment. They can finance up to 50,000 euros with the loan.

The ERP Gründerkredit – StartGeld is a state-subsidized loan for financing investments and working capital for young companies. It is aimed at people interested in founding a company with an entrepreneurial plan who want to venture into self-employment. The loan is intended to enable the founders to implement their plans and successfully survive the first few years.

What measures are supported?

The program provides financial support in the form of a loan that can be used to finance measures that promote the growth of the company.

The support includes the following measures:

- Investments in fixed assets

- Investments in working capital

- Investments in software

- Investments in consulting services

- Investments in training and further education

The X-Group consists of a competent team, who are versatile and competent. I was allowed to work with several experts and everyone was committed to me.

The customer is in the foreground with his need, his project and his resources.

I am absolutely grateful for an intensive accompaniment, advice and support with a priceless added value on the personal as well as professional level. [...]

What are the requirements?

If you are interested in taking advantage of the ERP Gründerkredit – StartGeld, you should first make sure that you meet the following criteria:

- You have the required professional and commercial qualifications.

- As a founder, you have completed your start-up concept and can present a business plan

- As an entrepreneur, you are authorized to manage and represent the company and are registered in the commercial register

- You have fewer than 50 employees and a maximum annual turnover of 10 million euros or an annual balance sheet of no more than 10 million euros

- You are in possession of a German identity card or another valid passport

- You have your residence in Germany

- You are at least 18 years old

Which documents do I need?

The documents you need for KfW’s ERP-StartGeld fall into two categories: The documents you must submit for KfW and the documents KfW requests from your bank.

From your documents, the focus of your entrepreneurial activity and the prospects of success of the project must be based on meaningful figures. This should be evident from the following documents:

- Your business plan

- Your financial plan

- Your curriculum vitae

- Your company presentation

In addition, the following information is also required by KfW:

- Self-declaration of compliance with the definition of small and medium-sized enterprises as defined by the European Union (for interlinked companies form number 600 000 0196; for non-interlinked companies form number 600 000 0095). (remains with funding partner)

- Annex de minimis declaration of the applicant on de minimis aid already received, form number 600 000 0075. (Remains with the financing partner).

- Documents for the risk assessment (to be viewed at www.kfw.de/067)

- Data list “Facts relevant to subsidy” (order number 600 000 4933).

Loan amount and disbursements

Up to 100% of the total external financing requirement can be financed. The total external financing requirement of the subsidized project (including working capital financing) may not exceed 125,000 euros. The investment amount may exceed 125,000 euros if the excess amount is financed with own funds. Value-added tax may be co-financed, provided there is no entitlement to deduct input tax.

- maximum 125,000 euros per project

- maximum of 50,000 euros for working capital financing

As an applicant, you should contribute existing own funds if possible, as the amount of own funds is included in the credit rating by KfW. In the ERP-Gründerkredit – StartGeld, several loans can be granted per applicant, provided that the cumulative commitment amount does not exceed 125,000 euros (working capital maximum total 50,000 euros).

Requirements for further applications:

- 125,000 euros loan amount (incl. operating funds of max. 50,000 euros) has not yet been exhausted

- the investment project that was previously financed has been completed

- the credits provided have been used in full and the control of the use of funds has been carried out

- loans already granted from the programs KfW-StartGeld (product number 061) and KfW-Gründerkredit – StartGeld (065) are counted towards the maximum amount of 125,000 euros

Further conditions

The minimum term is 2 years. You have the choice between two term variants:

- maximum 5 years, of which maximum 1 year is grace period

- maximum 10 years, of which a maximum of 2 years is grace period

The interest rate is fixed for the entire term of the loan. The interest rate is based on the development of the capital market and is fixed on the day of commitment. Interest is payable monthly in arrears on the last day of the respective month.

The applicable maximum interest rates (debit and effective interest rates in accordance with the statutory provisions) can be found in the overview of conditions for KfW development programs at www.kfw.de/konditionen.

During the grace period, you only pay the interest on the loan amounts disbursed. You then repay the loan in equal monthly installments. In the event of unscheduled repayments, an early repayment penalty will be charged.

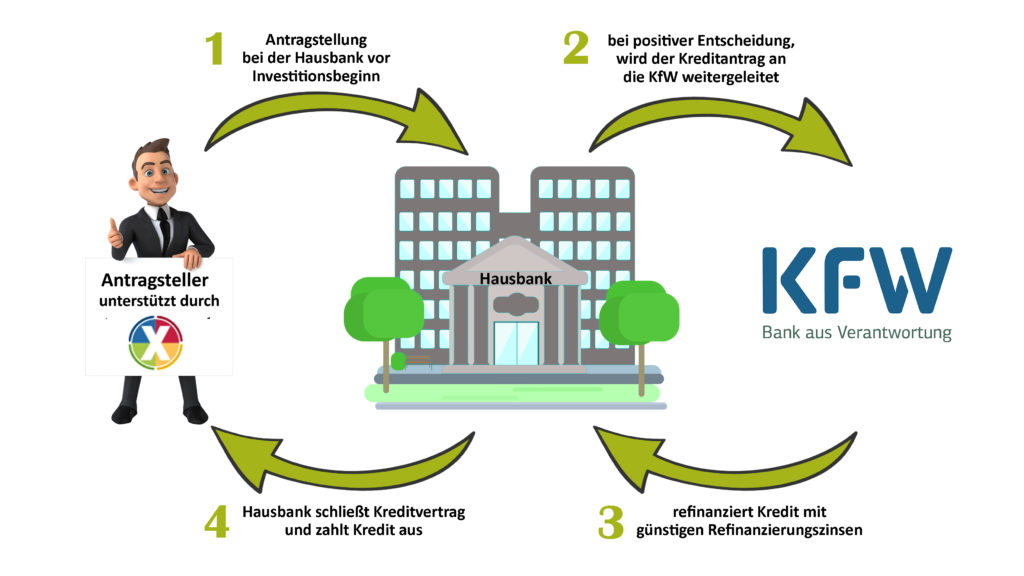

What are the next steps?

- Step 1: Prepare application with the KfW Funding Assistant.

- Step 2: Find financing partner and discuss project

- Step 3: Apply for a loan through the financing partner

- Step 4: Loan application is reviewed by KfW and a decision is made on funding approval

- Step 5: Conclude loan agreement with financing partner and implement project

Arrange a free initial consultation

For 20 years, our experts have been helping founders and entrepreneurs in a wide variety of industries prepare application documents and guide them through the financing process. Feel free to contact us to arrange a free initial consultation. Here we will discuss your project and a possible implementation.

I am thrilled throughout. From the first contact to the conclusion, I was always advised quickly, competently and very individually. Not only the cooperation with my consultant Mr. Wagner was very pleasant but also his colleagues from the organization were very accommodating and competent. I hope there will be the opportunity to work with him again, because the advice I received really helped me. [...]